Hi! Welcome to my website 🙂

I am Evangeline A. Santos — an accredited CPA Public Practitioner and BIR Accredited Tax Agent Practitioner (TAP).

You may call me as Yljien. I’m also known as EA Santos.

For more than 15 years, I gained experience in accounting profession especially in the areas of …

- Business/ Financial Planning and Management Reporting,

- Cost Management and Control,

- Formulation of Company/Business Policies and Procedures,

- Business/Financial Planning, Analysis and Control,

- OPEX and CAPEX Budgeting and Monitoring,

- Business/Financial Dashboards or Model,

- Payroll and/or Incentives Schemes Formulation,

- Computation and Administration, Formulation of Performance Measurement and Key Results Areas,

- Business/Financial Process Improvements,

- Financial Accounting, Reporting and Compliance

- Tax Adviser and Consultant

Currently, I am a consultant/adviser, writer/author, resource speaker/lecturer and a practitioner of profession offering Payroll, Tax, Accounting, Bookkeeping, Consulting and Productivity Services.

And, for the past 5 years, I have been conducting Trainings, Webinars and Workshops about Payroll, Tax, Accounting/Bookkeeping, Consulting and Productivity.

Few of my services are Letter of Authority (LOA) case handling, Subpoena Duces Tecum (SDT) case handling, and DOJ Tax-related case assistance. As such, I have an understanding on what is happening during the Tax Audit and Investigation, how a big deficiency tax assessments happen, and, how a LOA case elevates to a DOJ case.

HOW I GROW AS A SEASONED AND EXPERIENCED

CPA PUBLIC PRACTITIONER …

It started one day … back in 2017 …

I attended a Seminar and Workshop which tackled that there are tax regulations and issuances about Bookkeeping.

And after this very Training, the mentor chose participants to be involved in actual happenings of a LOA/Tax-case handling.

I am one of those lucky students … I became a mentee …

I learned and understood what are unearthed during Tax Audit and Investigations.

I learned where the Fiscal and Judge are coming from … what are they looking at when litigating a tax-case

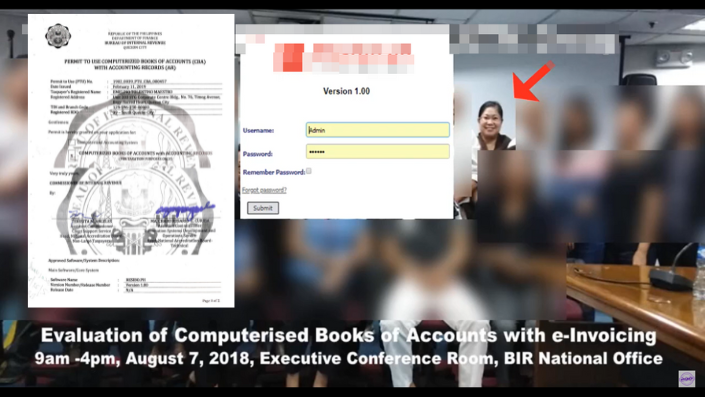

I learned what are being looked upon in CBOAs/CBAs before they are passed and approved and be given Permit-To-Use (PTU) certifications.

I gained the confidence of giving Trainings, Seminars, Webinars and Workshops.

In a nutshell …

These are HOW I had grown as a seasoned and experienced CPA Public Practitioner …

… These experiences added to my expertise …

Being involved in all of these … I am able to help business-owners/taxpayers, clients, and co-practitioners by providing them monthly retainers services, advisory and consultancy services, and/or coaching, seminars, and trainings.

Here’s My Business Registrations and Accreditations:

I’m glad to have you here and I appreciate your presence here!

Thank you for being here. Hearing success stories from readers and visitors who have obtained or created a living and whose finances, lives, relationships and health are improved with the skills, ideas and concepts learned from the educational materials kept here. I’m looking forward to your brighter future, and I’m glad to have you here!

To your peace of mind and confidence,